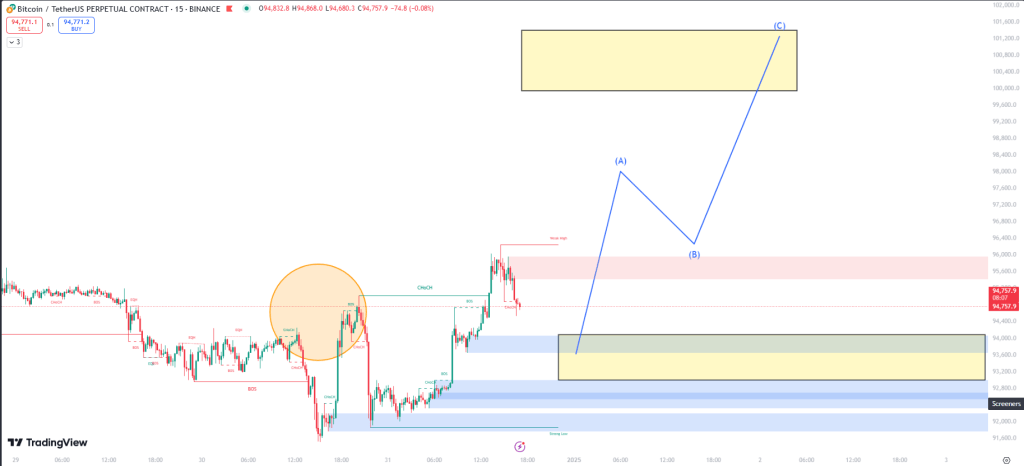

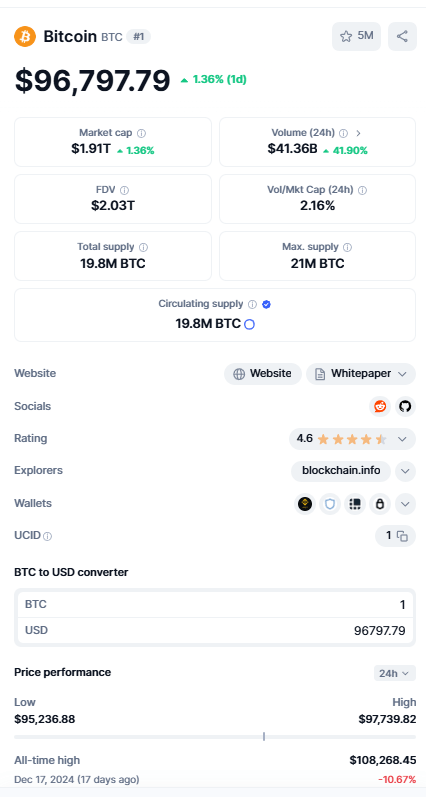

bitcoin price USD

watch full information _ https://blockscoutz.com

Bitcoin price USD

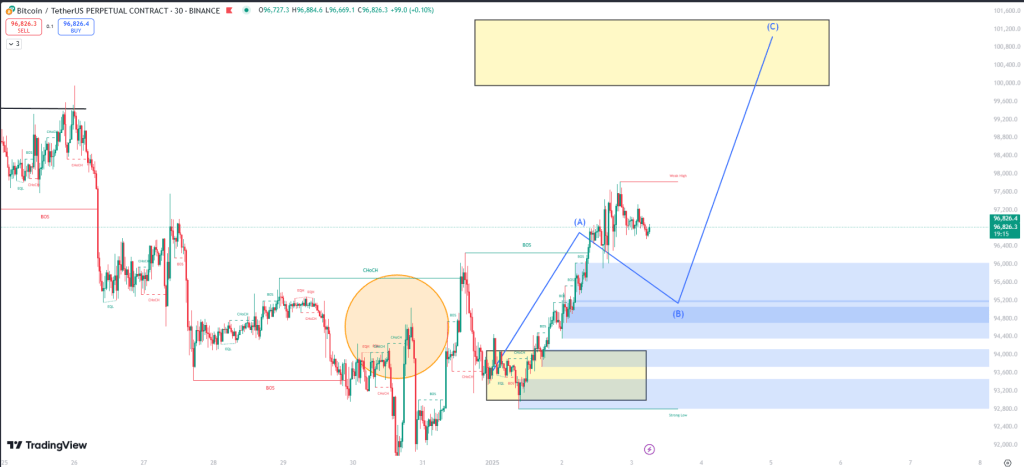

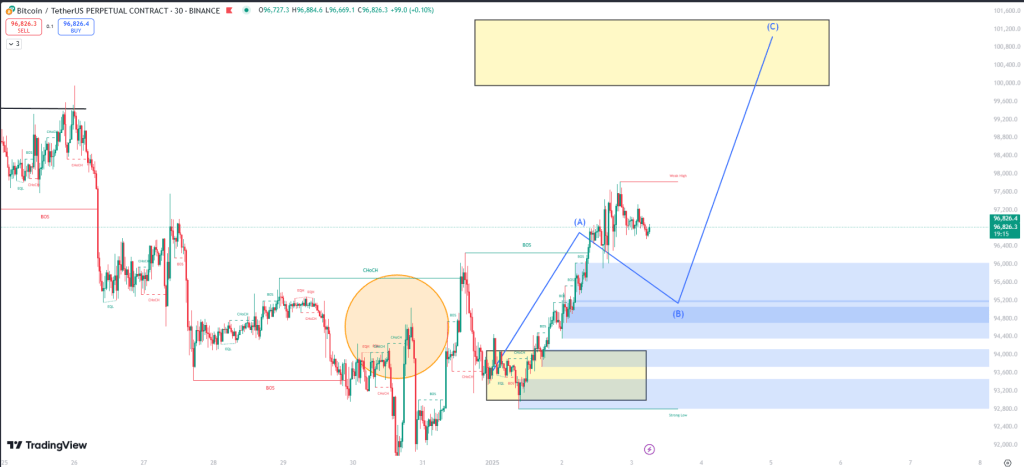

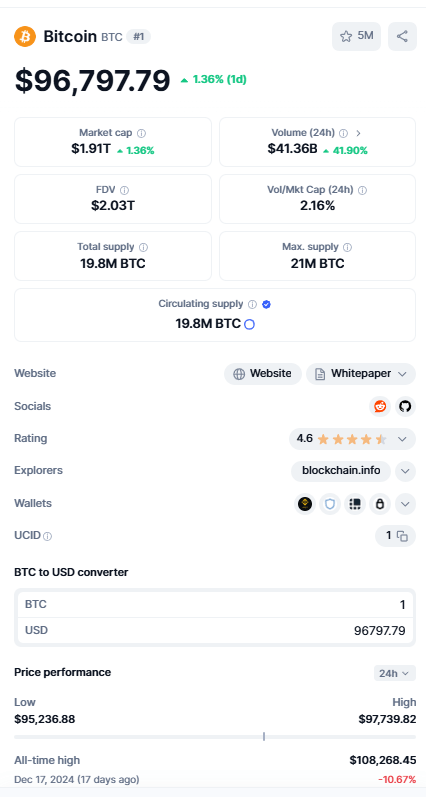

When Btc is valued, it can reach the limit of 50% (95 405:$). It may trend higher again and may reach the 100000$ mark later.

### When Bitcoin is Valued, It Can Reach the Limit of 50% ($95,405): An In-Depth Analysis

Bitcoin (BTC), the pioneer of cryptocurrencies, has continuously captured the attention of investors, financial experts, and enthusiasts worldwide. Known for its volatile nature, Bitcoin has the potential to surge to unprecedented levels, with analysts predicting it may reach the 50% valuation limit, approximately $95,405. Beyond this milestone, Bitcoin could trend even higher and hit the much-anticipated $100,000 mark. In this article, we’ll explore the factors influencing Bitcoin’s value, the potential road to $100,000, and what it means for the cryptocurrency market.

#### Understanding Bitcoin’s 50% Valuation Limit

The 50% valuation limit represents a significant milestone in Bitcoin’s journey toward broader adoption and increased market capitalization. This threshold often symbolizes an equilibrium point where market sentiment shifts between bullish and bearish trends. At approximately $95,405, Bitcoin would solidify its standing as a dominant asset in the financial world, reflecting growing investor confidence and adoption by institutions.

Factors that contribute to this valuation include:

1. **Institutional Adoption**: As more institutional investors enter the crypto market, Bitcoin’s credibility and demand grow. Companies like Tesla, MicroStrategy, and Square have already made significant Bitcoin investments, setting the stage for future institutional participation.

2. **Scarcity and Supply Dynamics**: With only 21 million Bitcoins ever to exist, scarcity plays a crucial role in driving its value. The closer Bitcoin gets to its supply cap, the higher its perceived value becomes.

3. **Market Sentiment**: Public perception and media coverage heavily influence Bitcoin’s price. Positive news, such as regulatory acceptance or technological advancements, can boost market sentiment, pushing prices higher.

#### The Road to $100,000: Key Catalysts

Bitcoin’s journey to the $100,000 mark is not just a speculative dream but a realistic possibility supported by several catalysts:

1. **Halving Events**: Bitcoin’s supply is halved approximately every four years, reducing the number of new coins entering circulation. This deflationary mechanism historically triggers significant price surges, as seen in previous cycles.

2. **Mainstream Adoption**: With Bitcoin gaining acceptance as a store of value and a medium of exchange, its utility continues to expand. Payment platforms like PayPal and Visa now support Bitcoin transactions, further integrating it into everyday commerce.

3. **Regulatory Clarity**: Positive regulatory developments provide legitimacy and reduce investor fears. Countries adopting favorable crypto regulations will likely contribute to Bitcoin’s growth.

4. **Technological Innovations**: Improvements in Bitcoin’s infrastructure, such as the Lightning Network for faster transactions, enhance its scalability and usability, making it more attractive to users and investors alike.

#### Potential Challenges on the Path to $100,000

While the outlook for Bitcoin is optimistic, it’s essential to acknowledge potential hurdles that could impact its trajectory:

1. **Regulatory Risks**: Stricter regulations or outright bans in certain countries could stifle adoption and negatively affect Bitcoin’s price.

2. **Market Volatility**: Bitcoin’s price history is marked by sharp fluctuations, which can deter risk-averse investors.

3. **Technological Competition**: Emerging cryptocurrencies with innovative features could challenge Bitcoin’s dominance.

4. **Macroeconomic Factors**: Global economic conditions, such as inflation rates and interest rate policies, can influence investor behavior and affect Bitcoin’s price.

#### What Reaching $95,405 and Beyond Means for the Market

Achieving the $95,405 valuation would have profound implications for the cryptocurrency market:

- **Increased Confidence**: A price surge to this level would likely instill confidence among retail and institutional investors, driving further investment into Bitcoin and other cryptocurrencies.

- **Market Maturity**: Such a milestone would signify a maturing crypto market, with Bitcoin solidifying its role as a digital asset comparable to gold.

- **Altcoin Growth**: As Bitcoin’s price rises, it often paves the way for altcoin appreciation, creating opportunities for a diverse range of crypto assets.

#### How to Prepare for Bitcoin’s Potential Surge

For investors, preparing for Bitcoin’s potential surge involves:

1. **Research and Education**: Stay informed about Bitcoin’s price trends, market news, and technological advancements.

2. **Diversified Investments**: While Bitcoin remains the flagship cryptocurrency, diversifying your portfolio with other promising assets can mitigate risks.

3. **Long-Term Perspective**: Bitcoin’s value proposition lies in its long-term potential, so consider holding rather than reacting to short-term price fluctuations.

#### Conclusion

Bitcoin’s potential to reach $95,405 and trend higher to $100,000 reflects its resilience and growing significance in the global financial landscape. While challenges remain, the factors driving Bitcoin’s growth provide a strong foundation for optimism. For investors and enthusiasts alike, staying informed and strategically planning for Bitcoin’s future is essential to navigating this dynamic and promising market.