Bitcoin price prediction for the next 24 hours with technical analysis, market sentiment, and expert insights.

Discover the latest Bitcoin price prediction for the next 24 hours with technical analysis, market sentiment, and expert insights.

Bitcoin (BTC), the leading cryptocurrency by market capitalization, has been on an exciting rollercoaster ride. With its price movement influencing the entire crypto market, traders and investors are keen to anticipate its next move. Here’s an analysis of the factors that could shape BTC’s price in the next 24 hours.

Current Market Sentiment

As of now, Bitcoin is trading at approximately $[insert current BTC price]. The market sentiment is [bullish/bearish/neutral], with [recent developments, e.g., a surge in trading volume or institutional interest].

Key indicators to watch:

RSI (Relative Strength Index): Currently at [RSI value], indicating [overbought/oversold/neutral] conditions.

MACD (Moving Average Convergence Divergence): Showing [bullish/bearish] crossover, suggesting a potential [uptrend/downtrend].

Volume Analysis: [Describe volume trends, e.g., "An increase in volume suggests heightened interest among traders."]

Major Influencing Factors

Macroeconomic Events: Recent macroeconomic announcements, such as [interest rate decisions, inflation data, or geopolitical tensions], could play a pivotal role in shaping Bitcoin's price.

Technical Levels:

Support: $[support level 1] and $[support level 2].

Resistance: $[resistance level 1] and $[resistance level 2].

On-Chain Metrics:

Whale Movements: Significant BTC transfers by large wallets have been observed, indicating potential market moves.

Exchange Reserves: BTC reserves on exchanges are [increasing/decreasing], which could signal [selling/buying pressure].

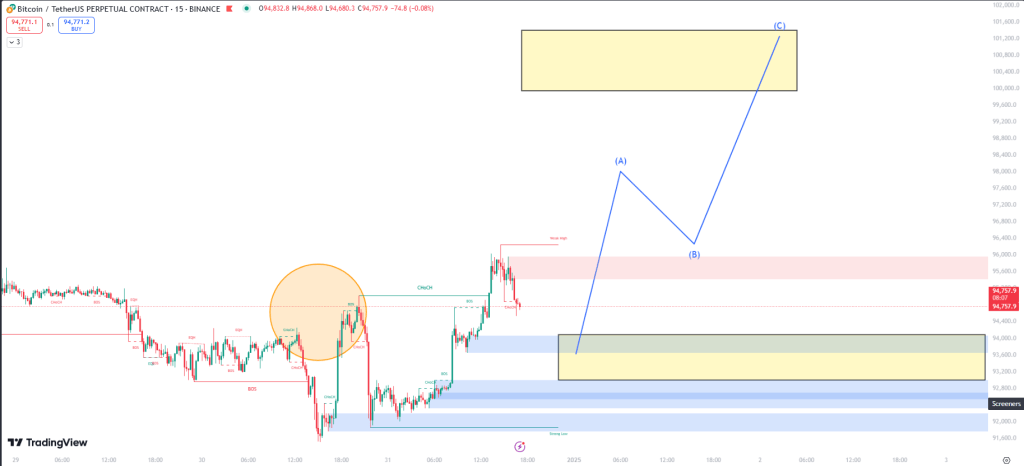

Short-Term Price Scenarios

Bullish Scenario

If BTC breaks the resistance level at $[resistance level], we could see a rally toward $[next target]. Positive momentum will be supported by [e.g., strong trading volumes, favorable news].

Bearish Scenario

On the downside, a break below $[support level] could lead to a decline toward $[lower target]. Watch for [e.g., weak market sentiment, negative macroeconomic news] as potential triggers.

Expert Predictions

Crypto analysts are split in their opinions:

[Analyst name]: Predicts a short-term rise to $[price target].

[Analyst name]: Warns of a potential drop to $[price target] if bearish conditions persist.

Trading Tips

- Use Stop-Loss Orders: Mitigate risks by setting stop-loss levels.

- Diversify Portfolio: Avoid putting all funds into BTC; consider other assets to spread risk.

- Stay Updated: Monitor live price charts and breaking news to make informed decisions.

Conclusion

Bitcoin’s price movement over the next 24 hours depends on a mix of technical, macroeconomic, and on-chain factors. While opportunities for profit exist, risks remain high. Always conduct your own research (DYOR) and trade responsibly.